RBI to Perform a G-SAP Bond Purchase Worth 20,000 crore Today

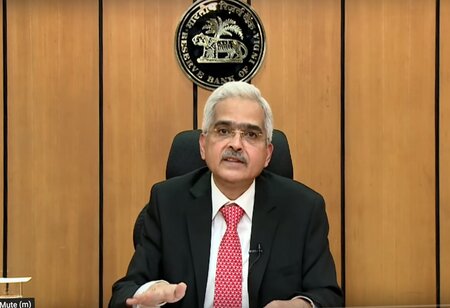

The Reserve Bank of India (RBI) will purchase government bonds worth 20,000 crore on the open market on Thursday as part of the G-sec Acquisition Programme (G-SAP 2.0). The Reserve Bank of India's governor, Shaktikanta Das, stated earlier this month that the bank will make these purchases to support the market.

The Reserve Bank of India (RBI) will purchase government bonds worth 20,000 crore on the open market on Thursday as part of the G-sec Acquisition Programme (G-SAP 2.0). The Reserve Bank of India's governor, Shaktikanta Das, stated earlier this month that the bank will make these purchases to support the market.

The RBI has kept a target of purchansing government securities of ₹1.2 lakh crore under the G-SAP 2.0 in the second quarter of the financial year. The next purchase for ₹20,000 crore is scheduled to take place on July 22.

The first such auction of ₹25,000 crore was held on April 15 this year. The second purchase of ₹35,000 crore took place on May 20. With the bond-buying plan, the RBI plans to keep a lid on long-term interest rates amid a massive government borrowing programme.

The government raises money from the market to fund its fiscal deficit through dated securities and treasury bills.

The RBI has said it remains committed to use all instruments at its command to revive the economy by maintaining congenial financial conditions, mitigate the impact of Covid-19 and restore the economy to a path of sustainable growth while preserving macroeconomic and financial stability.