Capital Structure – Meaning and Factors Affecting

By Tanuja A Akkannavar

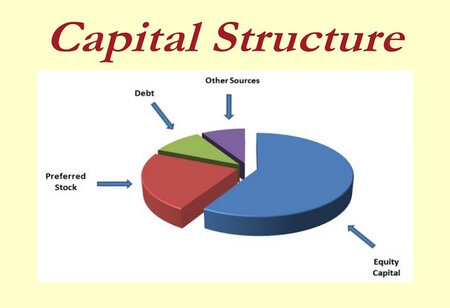

In order to operate efficiently, the capital structure is crucial for any organization. It shows the investment composition that includes a mixture of different sources from which long-term funds are raised that are required by the company. The capital structure influences the value of the company by impacting its capital costs or projected profits, or both, it should be such that the value of equity shares is improved or the income of equity owners is maximized.

In order to operate efficiently, the capital structure is crucial for any organization. It shows the investment composition that includes a mixture of different sources from which long-term funds are raised that are required by the company. The capital structure influences the value of the company by impacting its capital costs or projected profits, or both, it should be such that the value of equity shares is improved or the income of equity owners is maximized.

Through asking an organization to forgo their dividend payment and instead reinvest their profits to drive the company's operations, a company may opt to look at the investors who have equity to collect the funds. Through doing so, the investor’s hope that the capital put back would increase the company's value and, in turn, increase their equity value. The money put back, thus, constitutes capital from equity. However, the company's profits may not be enough to support the goals. The business is then presented with a decision to either abandon the plan or collect more money. There are three options for either investing, which means debt accrued, or selling more business shares or both. So, a combination of debt, internally created equity or new equity may be the capital structure.

Capital Structure Trends

When an organization analyses what capital structure it may choose to implement,

- Financial structure of shares of equity only

- Structure of wealth of equity and corporate bonds

- Structure of capital of equity debentures

- Structure of capital of bonds, preferred shares and debentures

The company's capital structure relies on several variables, such as legal requirements, tax rate, company growth, company size, existence, leverage, and more. The factors which affect the structure of capital are listed below:

1. Choice of Investors –

A company's strategy is normally to have separate investor groups for shares. Therefore, a capital structure should give all kinds of investors’ ample options for investing. Generally, confident and optimistic investors go for equity capital, and loans and debentures are typically raised with aware investors in view.

2. Cash Flow –

The potential cash flow situation should be taken into consideration when selecting the capital structure. Debt capital can only be used if the operating cash situation is very strong, as a lot of cash is required to pay debt and repay capital.

3. Growth and Stability –

A company's capital structure is strongly impacted by the growth and stability of its revenues, if a company's revenues are projected to remain reasonably steady, a higher level of debt can be increased. Sales stability means that the company will not face any challenges in fulfilling its fixed interest and debt repayment obligations.

4. Flexibility –

In an organization, the capital structure is such that the all contractions and strategies are relaxed. When time allows, preferred shares and loans may be repaid again, while at any level that offers rigidity to plans, equity financing cannot be refunded. The company could then continue to issue debentures and other loans in order to make the capital structure feasible.

5. Size of a Business –

The capital structure of small-size business companies typically consists of bank loans and retained income. On the other hand, the issuance of bonds and debentures as well as loans and borrowings from financial institutions can easily be used by large corporations with goodwill, stability and a defined benefit. The larger the size, the broader the total capitalization is.