Factors a Company should Look out for Before Asset Allocation

By Tanuja A Akkannavar

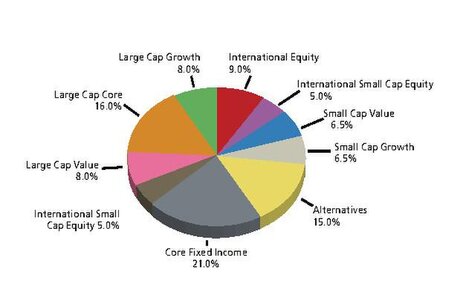

The distribution of assets involves dividing an investment portfolio between various types of assets, such as stocks, bonds and cash. Asset allocation refers to an investment strategy in which a company split their investment portfolios to minimize investment losses between various asset groups. There are three broad types of asset classes such as equities, fixed-income, and cash and equivalents.

The distribution of assets involves dividing an investment portfolio between various types of assets, such as stocks, bonds and cash. Asset allocation refers to an investment strategy in which a company split their investment portfolios to minimize investment losses between various asset groups. There are three broad types of asset classes such as equities, fixed-income, and cash and equivalents.

One of the major factor to consider while allocating a company’s asset is to first find out the level of risk profile. How can a company find out its risk profile?

1. Risk Tolerance is how much risk physically, and mentally, and organizational management can handle.

2. Risk appetite is how much risk is a company prepared to handle.

3. Risk Capability is the amount of risk a company is able to take.

When making investment choices, a company’s portfolio is affected by variables such as personal objectives, risk tolerance level, and investment horizon. Following are some of the factors a company has to determine before Asset Allocation:

1. Organizational Goals:

The objectives of the business to achieve a defined amount of return or saving for a specific purpose or desire, and various goals impact how a company spends and risks.

2. Time Horizon:

The time horizon factor depends on the amount of time a company can spend, most of the time, it depends on the investment's purpose. Likewise, different time horizons require different tolerance to risk. In general, it is important to balance the investments with the company needs for financial support in the upcoming days. A long term investment period means that, because a company has a time they can invest in assets such as equities and a short term investment period includes assets that are more durable and liquidity.

3. Threat Acceptance:

In the process of asset allocation, the threat acceptance refers to how willing and able a business is to sacrifice a certain amount of its initial investment in expectation of a better return in the future. Risk-averse investors withhold their portfolio for safer assets, while more bullish investors, on the other hand, and risk the bulk of their savings for higher returns in anticipation.

4. Investment Selection:

A business should be aware of the presence of a broad variety of investment items, including alternative investment mutual funds, corporate and municipal bonds, lifecycle funds, exchange-traded funds, money market funds. Investing in a combination of stocks, shares, and cash can be a successful option for many financial objectives.

5. Reallocation:

Reallocation and allowance of the portfolio are potential techniques for risk management. Keeping an eye on a company’s stock valuations keeps them sharp and concentrated on what's essential, and this will help in making the necessary modifications as circumstances change.

Why Asset Allocation is Necessary?

A company can protect against major losses by including asset categories with investment returns that shift up and down under within a range of market conditions. The returns of the three main groups of assets have traditionally not gone up and down at the same time. Market dynamics that may cause one asset category to do well also and average or low returns for another asset category. This will reduce the chance that a company will lose money by investing in more than one asset group, and the total investment returns of their portfolio will have a smoother ride.