Copy Trading in Nigeria

By Team Consultants Review

Who would not love to earn money with little effort? The digitized economy offers a few ways that actually work. In the world of foreign currency exchange, beginners and veterans alike use copy trading to save time and gain profits with little participation. Here are the basics of this strategy, which is becoming increasingly popular in Nigeria.

In this marketplace, national currencies are bought and sold by institutions and individuals. While hedge funds, large banks, and other entities account for over 90% of all trades, any Internet user could succeed in exchange for a profit. As the rates are always in flux, a prudently timed transaction could result in significant gains.

What It Is All About

Humans are averse to losses by nature. This is a general tendency not limited to stocks and other investments. Hence, it is perfectly normal to be afraid of making mistakes. When actual money is at stake, traders could feel risk-averse, especially beginners. One of the ways to reduce the likelihood of losses is to delegate to an Alpari professional.

Generally, success in the field requires certain knowledge. All those pairs, spreads, and a host of other indicators could be confusing to rookies. However, the job may be assigned to a skilled finance professional, who is referred to as Strategy Manager. Such is the service of Alpari copy trade, which is now available in South Africa.

This trader will then handle a predetermined portion of your funds and invest it for you. As they open positions, place orders and execute trades with their portfolio, you will see the same operations replicated in your account. Basically, it looks as if you were conducting the operations by yourself, but the decisions are made by the strategy manager for a fee.

Since its inception, the scheme has brought dramatic changes to the very concept of trading. It no longer requires active decision-making at your end. All you need to do is pick an effective trader and trust them with a portion of your portfolio. Meanwhile, you maintain complete control of the operations and may terminate the arrangement whenever necessary.

How It Works

Once you agree to use copy trading via your broker, your account is linked with that of the expert. This refers to only a portion of the portfolio up to a maximum limit (for example, 20%). Hence, if your balance is $1,000, only $200 will be added to the copied trader’s funds.

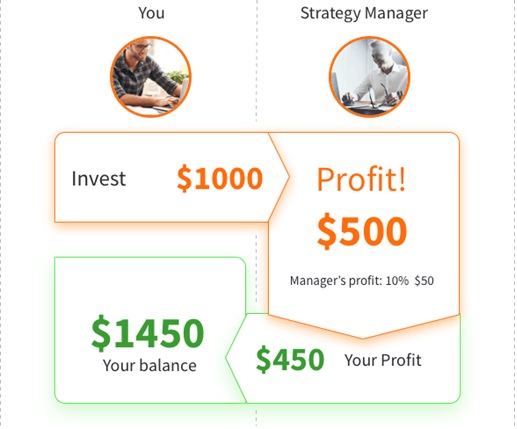

All the subsequent trades executed by the chosen expert are replicated or copied, into your account, hence, the name. In case of a profitable transaction, the expert is eligible for a certain fee. For instance, if you invest $1,000, and they generate $400 profit using the sum, you receive $360 ($40 deducted as a fee). No action required, just sit back and watch your balance grow!

Other Advantages to Gain

Different providers have different terms for the strategy. Here are the key benefits of Alpari:

- Simplicity

You can delegate trades to an expert and gain profits with no complex knowledge required.

- Control tools

The software allows you to select a strategy manager, determine the amount you wish to invest, and monitor their performance closely. As a client, you may invest and withdraw funds as you see fit.

- Security

Whatever the expert does, you can be sure your account and data remain protected.

- Accessibility

The signature platform software (MetaTrader 4 and 5) is optimized for mobile devices. Hence, you can access all Forex trading data easily wherever you are, even on the go.

Is There a Catch?

Of course, there are a few important caveats. Remember to maintain control and check the trader’s performance regularly using the available monitoring tools. No broker can guarantee the complete absence of risk. However, the fee is only paid for profitable transactions.

The more you invest, the more you could gain or lose on the market. If you feel the strategy manager’s performance is falling short, you can stop the connection. Some platforms also allow you to cancel the replication of separate unsatisfactory trades. Even though you could still gain without lifting a finger, it is always best to remain in control.