How technology and driving habits are causing a churn in the auto industry

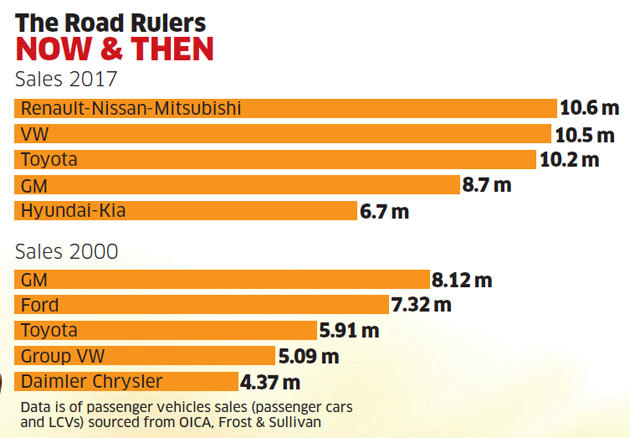

The global automotive industry was in for a surprise in 2017. Led by Carlos Ghosn, the French-Japanese alliance of Renault-Nissan-Mitsubishi (RNM) grabbed the top spot. From being ranked fourth in 2016 sales chart, it had sold 10.6 million passenger vehicles (passenger cars and LCVs) in 2017. The recent past had seen Toyota Motors and Volkswagen Group dominating the chart. RNM sold 10 million vehicles for the first time in 2017, on the back of a big boost from China. It became the only carmaker, besides Volkswagen (VW) and Toyota, to do so.

“This evolution reflects the breadth and depth of our model range, our global market presence and the customer appeal of our vehicle technologies,” Ghosn had said in a statement.

Fasten Your Seatbelts

This was a dramatic upset by any yardstick. In the deep-pocketed automobile industry, pecking order matters and rankings are zealously guarded. But the missing vroom factor in RNM’s ascent is part of a larger story that is unfolding in the car industry.

The industry, hitherto fired up by petrol and diesel, has been witnessing some tectonic shifts. Pole positions have changed between 2000 and 2017 (see The Road Rulers). Detroit giants Ford Motors and General Motors — leading the chart in 2000 — have been slowing down for a while. Daimler Chrysler has dropped off the chart (Chrysler is now Fiat Chrysler). Many undercurrents also fuelled these shifts between 2000 and 2017.

The rise of China, the shift of centre of gravity from the West to the East, a sharp surge in mergers and acquisitions in an industry seeking scale and cost efficiencies are just some of these. “The top deck has dramatically changed in the last 17 years,” says Aswin Kumar P, program manager, South Asia & Middle East, Frost & Sullivan.

Erstwhile leaders like VW and Toyota have faced their share of troubles recently, helping RNM’s rise. VW has been reeling under the blow from a scandal involving fixing diesel emission results. Its CEO was replaced a couple of days ago. The hybrid focused Toyota, with a weak presence in China, is weighing its future, where electric vehicles (EVs) will dominate. Hot on the heels of the major companies have been the aggressive Korean player, Hyundai-Kia, whose rise to the top five though has been in the works for a while.

This is just a trailer, say industry analysts. The automotive industry, which grew on the back of internal combustion engine, is priming for bigger disruptions. The past has been about making cars smarter, more fuel efficient and features rich, chasing mostly incremental shifts. “The next 10 years will see more dramatic turns,” says Kumar.

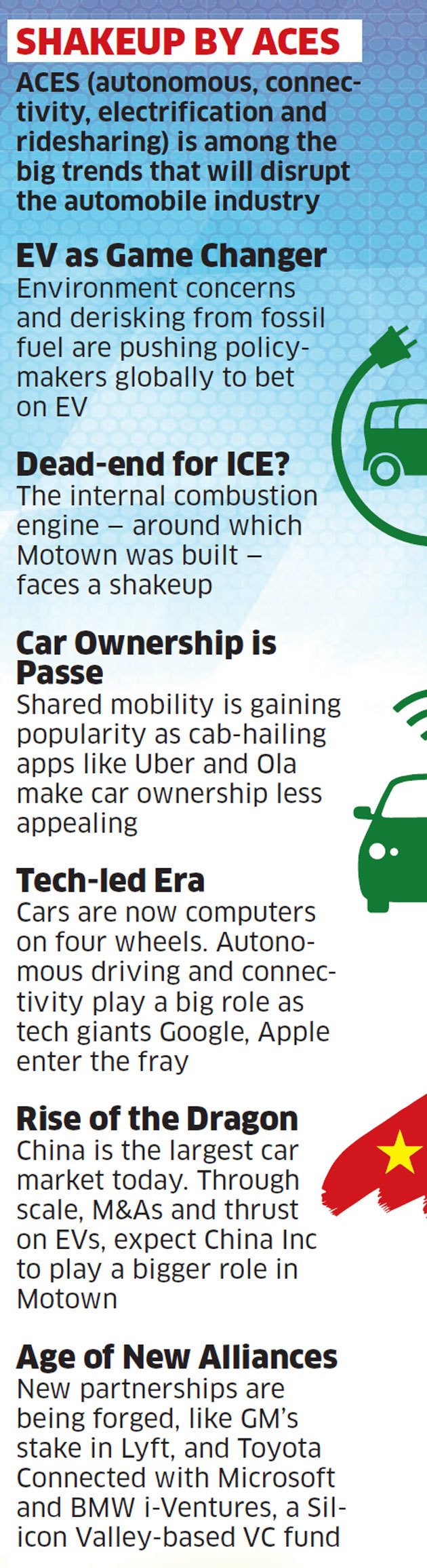

ACES (autonomous, connected cars, electrification, and shared mobility) is the big trend reshaping the market. With the rising popularity of ride-hailing apps such as Uber and Ola, shared mobility is making car ownership passe. Technology giants like Google and Apple are knocking at the doors of auto majors, as cars become computers on four wheels.

Says Hormazd Sorabjee, editor, Autocar India: “In future, things will be very unpredictable. We are entering the most disruptive phase in the automotive industry.”

Among the major factors reshaping the pecking order is the world’s most populous country. “China is the game changer. By 2020, China will sell almost twice as many cars as the US. Who wins in China, wins globally,” says Michael Dunne, president of the consultancy firm Dunne Automotive.

Ford dropping out of the top five, GM slipping and VW revving up — with 4 million unit sales in China in 2017 — clear all doubts in this context. China-made cars are increasingly gaining a toehold. Once makers of cheap cars, homegrown Chinese firms are rising up the value curve. Geely, for example, acquired Volvo and made some deft R&D moves.

Tech, the game changer

Virtually every carmaker is latching on to the EV bandwagon. Europe is saying goodbye to diesel. Based on recent announcements, Frost & Sullivan forecasts about 25 million EVs will be sold by 2025 and over 400 models will be available. “The bet should be on leading Chinese domestic car brands such as Geely, Great Wall and BYD, which are privately-owned enterprises with an entrepreneurial spirit,” adds Jacob.

“A car is becoming less of a mechanical and more of a software product,” says Rakesh Batra, partner (automotive), EY. Imitating the handset industry, hardware and components are increasingly getting commoditized. Software and electronics are becoming the differentiators. Says Wilfried G Aulbur, senior partner, Roland Berger: “With these disruptions, it is less clear what value propositions will OEMs (original equipment makers) bring in the future.”

These disruptive times are stoking a new wave of alliances and deals. So far, such deals were mostly about intra-industry tieups, where companies sought economies of scale, cost savings and new markets — a wave signalled by the RNM alliance. Those of the future will increasingly be driven by technology needs and would often see cross-industry alliances.

“MADE (mobility, autonomous, digital and electric) disruptions require unprecedented investments from OEMs,” says Aulbur. Adds Sorabjee of Autocar India: “OEMs have to hedge against a wide range of bets. With limited resources, each will make a considered choice.” GM’s exit from India and the sale of Opel should be seen as tactical retreats, giving it headroom to focus on core markets while building future capabilities like investing in ride-hailing app Lyft or acquiring self-driving startup Cruise Automation.

“Access to technology will be a big driver,” says Singapore-based Vivek Vaidya, senior president, mobility, Frost & Sullivan, Asia-Pacific. So serious is the technology threat that it is fuelling interesting partnerships. German rivals BMW and Daimler are joining forces to create a mobility behemoth that includes a range of services such as car sharing, ride-hailing, parking and EV charging infrastructure.

Arch rivals Toyota and VW are coming together to build low-emission commercial vehicles and automated driving capabilities. Auto-tech alliances are also surging, like Google’s Waymo with Fiat Chrysler or Volvo with Uber. A mega alliance of 33 companies — including Apple, Google, Tesla, Intel, Baidu, Bosch and Lyft — has started to work on autonomous technologies.

A consortium of automakers, including Ford, Toyota and Suzuki, is developing standards for in-vehicle car telematics as alternatives to Google Android Auto and Apple CarPlay. Last year, 13 firms from the energy, transport and industrial sectors joined hands with oil and gas giants such as Shell and Total to invest $10.7 billion to work on nonpolluting fuel cell vehicles. How will all these play out in India?

An Outlier

In this global churn, India has remained an outlier and a geography out of the reckoning. It has largely been a small-car market. The leaders here have been Suzuki and Hyundai, who have over 70% of the car market. The pace of adoption of EVs and new technologies like autonomous cars would be markedly different in India when compared with the West and China.

“EVs will have a slow journey in India. It is not just about new models but also about the ecosystem. I expect public transport and commercial fleet to get electrified first. Passenger vehicle will be the last,” says Batra of EY.

But things are changing. India just overtook Germany to become the fourth largest (after China, the US and Japan) automobile market, with sales crossing 4 million. Large markets like North America, western Europe and Japan are seeing a decline or freeze in sales growth. Thanks to the rising popularity of shared mobility, car ownership is declining in these regions. Even the number of new driving licences being issued in countries like France is declining. This makes China and India important for companies wanting to get into the top five.

“For most manufacturers, success in China is critical to their global success. India is equally important,” says Kumar Kandaswamy, senior director, Deloitte Touche Tohmatsu India. But making a sizable mark in India might be easier said than done.

“American and European companies will continue to struggle in India as Suzuki-Toyota and Hyundai-Kia further tighten their grip on Indian roads,” says VG Ramakrishnan, MD of automotive consultancy Avanteum Advisors. In this context, Toyota’s sales alliance with Suzuki Motors makes sense. Toyota’s weak presence in China makes its India play even more critical.

“Barring Toyota, all the others in the top five have a good presence in China. Difficult China-Japan ties add to the troubles,” says Aswin Kumar of Frost & Sullivan.

“The two together, alongside Hyundai-Kia, will further concentrate on the India market, making it harder for other players to gain a grip here,” says Batra.

The pecking order in India may be predictable. But global rankings seem to be packed with surprises. As cross-border and cross-sector alliances are being built and rivals join hands for survival, Motown’s future rankings may not be about pure-bred auto companies at all.

“This evolution reflects the breadth and depth of our model range, our global market presence and the customer appeal of our vehicle technologies,” Ghosn had said in a statement.

“This evolution reflects the breadth and depth of our model range, our global market presence and the customer appeal of our vehicle technologies,” Ghosn had said in a statement.