Are Investment-Based Apps A Game-Changer for Beginners?

By Sthitaprajnya Panigrahi

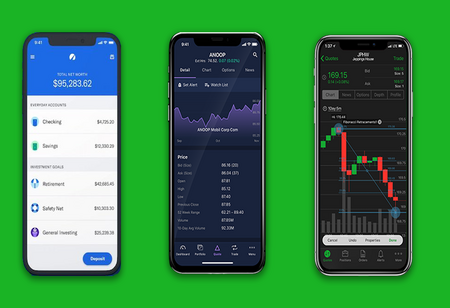

Rising trend of investment platforms have exposed the youngsters to the advanced fin-tech world. After the introduction of DIY (Do It Yourself) investing model, financial products like mutual funds have significantly caught the attention of Indian youths. Even if compiled with viable risk factors, the investment domain is significantly invaded by numerous pro-players and beginners who presume these risks as inevitable challenges and are eager to invest any way. The rise of digitization is acting as a catalyst in this sector by providing enough exposure for the new-age investors who expand their knowledge base by referring to abundant online articles and websites. Amidst the rising popularity of financial investment products, app-based and online investment platforms have played a substantial role in this. Authorizing beginners to create and manage their own investment portfolios, these investment-based applications are enabling the debut investors without compelling them to depend on third-party financial agents.

Rising trend of investment platforms have exposed the youngsters to the advanced fin-tech world. After the introduction of DIY (Do It Yourself) investing model, financial products like mutual funds have significantly caught the attention of Indian youths. Even if compiled with viable risk factors, the investment domain is significantly invaded by numerous pro-players and beginners who presume these risks as inevitable challenges and are eager to invest any way. The rise of digitization is acting as a catalyst in this sector by providing enough exposure for the new-age investors who expand their knowledge base by referring to abundant online articles and websites. Amidst the rising popularity of financial investment products, app-based and online investment platforms have played a substantial role in this. Authorizing beginners to create and manage their own investment portfolios, these investment-based applications are enabling the debut investors without compelling them to depend on third-party financial agents.

This article discusses the various factors and highlights how app-based investment platforms have emerged as a game-changer for the current generation of investors who are vigorously exploring and investing on their own.

- Easy to Register: Forbidding the investors to go through complicated and time-consuming manual process, investment-based applications are easy to register and commence. Currently these online investing is a more feasible option as there are seldom any concealed commission fees. Usually, the regular plans involve an extra charge being paid by the investment platforms to the intermediate players who can either be an advisor, broker or distributor.

- Plenty of Choices to Explore and Invest: At present, the budding investors can commence their investing journey with minimum principal amount. Enabling the beginners to start with as minimum as Rs 100, not having adequate money to invest is not a valid reason any more. Offering thousands of plans and options via partnerships with multiple Asset Management Companies (AMCs), Online investment platforms have made it quite convenient for the investors to choose the plan which suits them. Additionally, the investors can also invest in SIPs or prefer to investment in lump sum via Systematic Transfer Plan.

- Detailed Investment Plans: Usually, it has been always been challenging for investors to learn and decipher which investment suits them. By accessing these factors, they can determine the amount they need to invest and achieve the desired goal, but app-based investment platforms have certainly transformed this dynamic. The investor can take a deep plunge into a particular plan to see why it can suit them. Across these platforms, the entire decision-making process is described elaborately with various relevant information such as fund ratings, a SIP or a one-time investment calculator, and more.

- Calculating the Risk Factor: One of the most crucial factors while investing across these applications is to evaluate how much risk the budding investor is willing to take. They should consider various factors like income, expenses, financial responsibilities, to know the exact risk factors involved in these scenarios. The investor may have a high income, but if there’s a huge financial responsibility in the immediate future, it’s generally suggested not to take aggressive risks. Considering from fund’s perspective, short-duration funds like Liquid Funds have low risk while Arbitrage Funds generally have a high risk. Conventionally, it will be very difficult for first-time investors to evaluate all these details, but app-based investments have made it easier now by highlighting the risks at the outset.